Sembcorp Industries 1H2025 Results

August 08, 2025

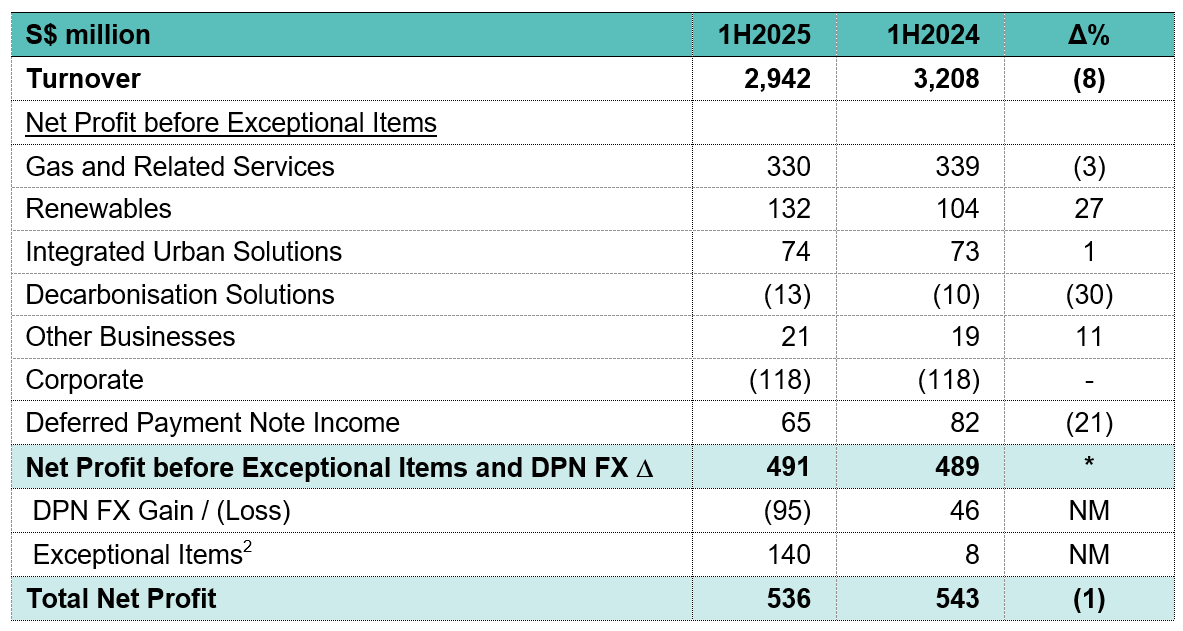

SEMBCORP POSTS NET PROFIT OF S$536 MILLION IN 1H2025

- Underlying Group net profit1 at S$491 million, comparable to S$489 million in 1H2024

- Interim dividend of 9.0 cents per share

Singapore, August 8, 2025 – Sembcorp Industries (Sembcorp) delivered a resilient performance for the first half of 2025 (1H2025). Underlying Group net profit was S$491 million, comparable to 1H2024 net profit of S$489 million. Group net profit after exceptional items (EI) was S$536 million, 1% lower than S$543 million in 1H2024.

Net profit before EI for the Gas and Related Services segment was S$330 million, compared to S$339 million in 1H2024. Earnings were steady as lower generation spreads in Singapore and the absence of contribution from Phu My 3 in Vietnam were offset by contribution from Senoko Energy.

Net profit before EI for the Renewables segment increased 27% to S$132 million in 1H2025, due to higher contribution from India on better wind resource and higher operational renewables capacity. Our gross installed renewables capacity increased to 13.8GW in 1H2025 from 10.0GW in 1H2024. However, performance was impacted by higher curtailment and lower tariffs in China.

The Integrated Urban Solutions segment delivered a stable net profit before EI of S$74 million, a slight increase from S$73 million in 1H2024, supported by higher land sales in Indonesia as well as improved earnings from the water business in China.

INTERIM DIVIDEND

The Board of Directors announces an interim dividend of 9.0 cents per ordinary share, which will be paid on August 26, 2025. We expect to maintain a sustainable dividend payout in FY2025, commensurate with our underlying earnings and in line with our dividend policy.

Quote from Wong Kim Yin, Group CEO of Sembcorp Industries: “Sembcorp delivered resilient 1H2025 results, despite macroeconomic uncertainties. The defensiveness of our portfolio will continue to underpin the resilience of our earnings. We remain focused on strengthening and growing our businesses to drive Sembcorp’s strategic plan towards 2028 and beyond, to deliver increasing value to our shareholders.”

FINANCIAL SUMMARY

– END –

1Underlying Group net profit refers to Group net profit before exceptional items (EI) and deferred payment note (DPN) foreign exchange gain / loss.

*Denotes amount of less than 1%.

21H2025 exceptional items (EI) totalling S$140 million comprised S$142 million profit from the sale of the waste management subsidiaries in Singapore, offset by S$2 million fair value loss on contingent consideration related to a prior acquisition in India. 1H2024 EI related to the gain on bargain purchase of a 100% equity interest in two special purpose vehicles of Leap Green Energy Private Limited in India.