Sembcorp Industries 1H2024 Results

August 06, 2024

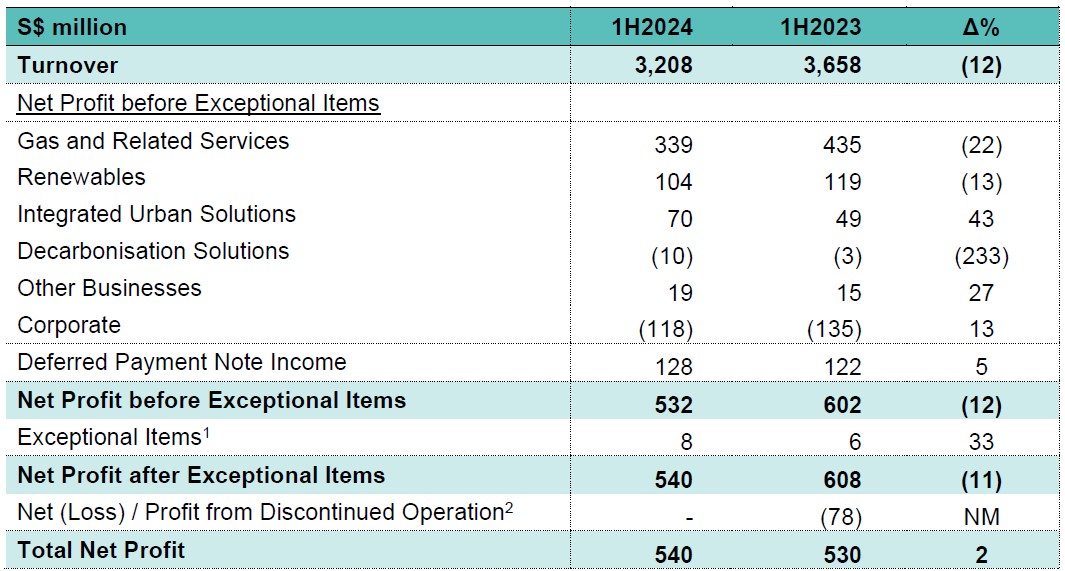

SEMBCORP POSTS NET PROFIT OF S$540 MILLION IN 1H2024

- Net profit before exceptional items at S$532 million, with Gas and Related Services portfolio providing high earnings visibility

- Increases interim dividend to 6.0 cents per share, from 5.0 cents per share

Singapore, August 6, 2024 – Sembcorp Industries (Sembcorp) posted a turnover of S$3.2 billion and Group net profit before exceptional items (EI) of S$532 million for the first half of 2024 (1H2024), compared to S$3.7 billion and S$602 million respectively in 1H2023. Group net profit after EI and discontinued operation was S$540 million, 2% higher compared to S$530 million in 1H2023.

Net profit before EI for the Gas and Related Services segment was S$339 million, compared to S$435 million in 1H2023. Excluding the planned major maintenance for the Singapore cogeneration plant in 1H2024, earnings for the segment remained resilient despite a decline in Singapore wholesale power prices. 99% of the Group’s gas-fired power portfolio in Singapore is contracted, backed by long-term power purchase agreements.

Net profit before EI for the Renewables segment decreased 13% to S$104 million in 1H2024 from S$119 million in 1H2023, due to higher curtailment in China. This was offset by contributions from new acquisitions.

The Integrated Urban Solutions segment posted net profit before EI of S$70 million, a 43% increase from 1H2023, due to a recovery in Vietnam and Indonesia land sales.

Quote from Wong Kim Yin, Group President & CEO of Sembcorp Industries: “Sembcorp produced resilient 1H2024 results despite lower wholesale power prices and a major maintenance for our gas-fired power plant in Singapore. This can be attributed to our contracting strategy. The robust contribution from our portfolio provides a strong anchor for our 2024 – 2028 strategy, with our portfolio of gas and renewable energy uniquely positioned to meet the strong and increasing demand expected from corporate customers including data centres.”

FINANCIAL SUMMARY

INTERIM DIVIDEND

In light of the robust earnings and confidence in the Group’s earnings trajectory, the Board of Directors announces an interim dividend of 6.0 cents per ordinary share, which will be paid on August 22, 2024. This is an increase of 1.0 cent, from the interim dividend of 5.0 cents per ordinary share for the first half of 2023.

GROUP OUTLOOK

The Group showed resilient performance in the first half of 2024.

Contribution from the Gas and Related Services segment was lower mainly due to the planned major maintenance in Singapore. The Renewables segment saw higher curtailment in China. This was offset by an increase in earnings from the Integrated Urban Solutions segment, with an increase in land sales in Vietnam and Indonesia.

With the completion of the planned maintenance for the cogeneration plant in Singapore and a significantly contracted position, earnings for the Gas and Related Services segment are expected to be higher in the second half of the year, compared to the first half of 2024.

Earnings for the Renewables segment are expected to be lower, due to seasonality in the second half of 2024, partially offset by new project contributions. The weak macroeconomy in China could continue to negatively impact renewable energy demand.

Outlook of the Integrated Urban Solutions segment is expected to be stable.

Macroeconomic uncertainty remains and geopolitical tensions, as well as potential policy changes could impact the global economy and impact business performance.

Barring unforeseen circumstances, full year net profit before exceptional items for the Group is expected to be fairly stable. The Group is well-positioned to navigate the path of energy transition and grow its renewables portfolio. The Group will continue to focus on the execution of its 2024 – 2028 strategy, to capture market opportunities in the energy transition and drive value creation.

– END –

11H24 exceptional item (EI) is related to the gain on bargain purchase of a 100% equity interest in two special purpose vehicles (SPVs) of Leap Green Energy Private Limited (Leap Green) in India. 1H23 EI comprised divestment gains of S$5 million from the sale of its water businesses in Indonesia, as well as recognition of a S$1 million negative goodwill arising from the acquisition of a 49% joint venture in the solar business in Vietnam.

2 The Group completed the sale of Sembcorp Energy India Limited (SEIL) in January 2023 and the financials are reported under discontinued operation.