Proven track record of tapping sustainable financing

Following the launch of the Sembcorp Green Financing Framework and the Sembcorp Sustainable Financing Framework in 2021 and the subsequent update of the Sembcorp Green Financing Framework in 2024, we have successfully issued green and sustainability-linked bonds and loans to pursue our growth objectives.

Learn more about our sustainable financing.

Capital recycling

Reinvesting the proceeds in our businesses allows us to enhance returns and create value for our shareholders. We continually evaluate our portfolio and explore the option of capital recycling to support our growth and optimise our portfolio. We are committed to ensuring that our capital recycling efforts are firmly aligned with our long-term financial goals and sustainability targets.

Disciplined capital management

Capital Management

Net Debt / Adjusted EBITDA

Net Debt / Adjusted EBITDA

Adjusted EBITDA / Interest

Adjusted EBITDA / Interest

Prudent debt management

We proactively manage our debt maturity profile as well as cost of debt, balancing it with a mix of floating and fixed rate debt to ensure competitiveness in the current interest rate environment.

Group Debt Profile

Debt Maturity Profile as at Jun 30, 2025 (S$ million)

Debt Maturity Profile as at Jun 30, 2025 (S$ million)

Hedging Profile

Hedging Profile

Weighted Average Cost of Debt

Weighted Average Cost of Debt

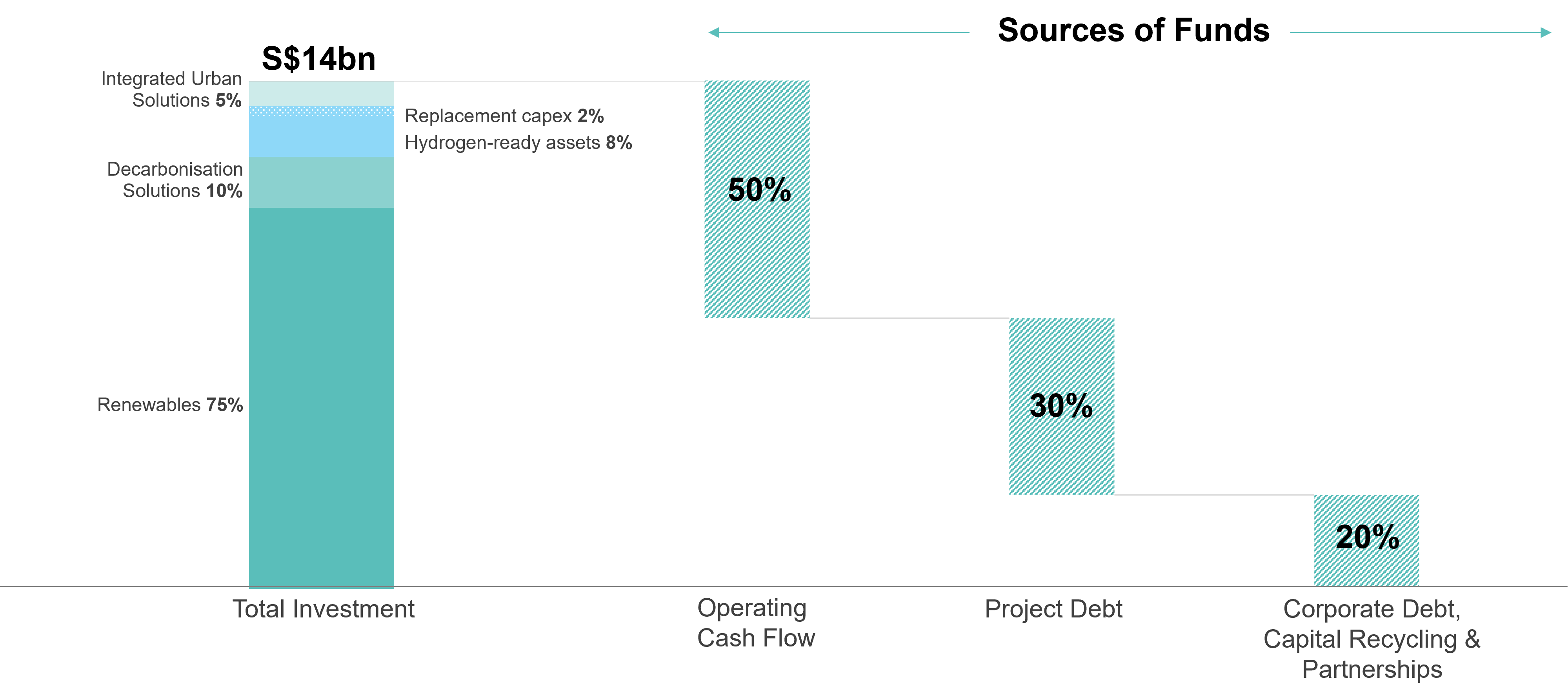

2024 – 2028 Capital Allocation Plan

*Median of peers’ LTM Net Debt / Adjusted EBITDA and adjusted EBITDA / Interest expense as at Sep 30, 2023. Adjusted EBITDA = reported EBITDA + share of result from associates and JVs, net of tax

**Annualised

Note: The above aspirations are management’s strategic plans for the next five years as announced during Investor Day 2023 in November 2023. The above aspiration, including capital allocation as well as sources of fundings, are based on potential investments, divestments, expiry of contracts / concessions as well as the efforts to secure new projects and contracts. There is no assurance that any of such actions may materialise, nor as to the terms and mode of such actions